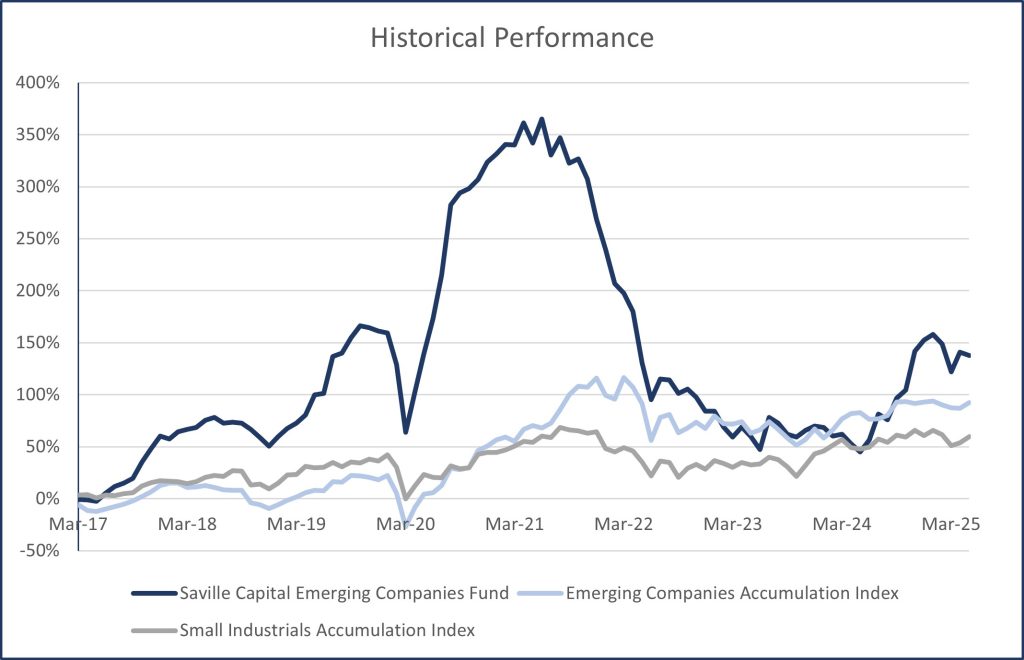

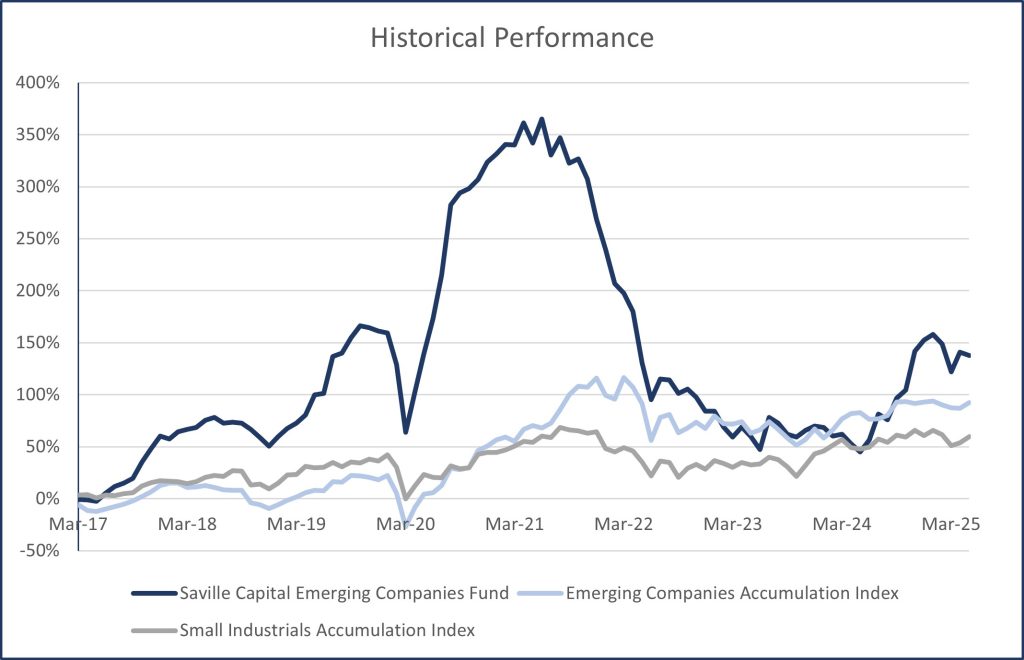

The Saville Capital Emerging Companies Fund is +137.8% since inception after all fees/expenses and assuming distributions are reinvested (or +165.5% if distributions have not been reinvested) vs the Emerging Companies Index and Small Industrials Accumulation Index at +92.4% and +59.9% respectively. On an annualised basis, the Fund has generated a return of +11.0% p.a. since inception.

Historical Performance

Monthly Performance By Calendar Year

Net of all base fees, performance fees and expenses of the Fund.

Disclaimer: The trustee for the Saville Capital Emerging Companies is One Funds Management Limited (ACN 117 797 403) (AFSL 300337) (OFML). The investment manager for the Saville Capital Emerging Companies Fund is Saville Capital Pty Ltd (ACN 614 694 316) (Saville). The investment manager (Saville) is an authorised representative of One Wholesale Fund Services Ltd (ACN 159 624 585) which holds an Australian Financial Services Licence (No. 426503). The information contained in this document or webpage was not prepared by OFML but prepared by other parties. This document or webpage contains general financial product advice only, and all of the commentary, statements of opinion and recommendations have not taken into account your personal circumstances. Any investment in OFML products need to be made in accordance with and after reading the Information Memorandum and any applicable supplementary Information Memorandum on issue. Prospective investors should consider the Information Memorandum and Supplementary Information Memorandum (if applicable) before deciding whether to invest in the Fund or continue to hold units in the Fund. The opinions, advice, recommendations and other information contained in this document, whether expressed or implied, are published or made by Saville in good faith in relation to the facts known at the time of preparation. You should also consult a licensed financial adviser before making an investment decision in relation to the Fund. Past performance is not indicative of future performance. The offer of units in the Fund is made in accordance with an Information Memorandum dated 23 December 2016 and the Supplementary Information Memorandum dated 24 September 2020 each issued by OFML. The Information Memorandum and Supplementary Information Memorandum can be obtained by visiting www.oneinvestment.com.au/savillecapital

Limitation of liability: Whilst all care has been taken in preparation of this document or webpage, to the maximum extent permitted by law, neither Saville or OFML will be liable in any way for any loss or damage suffered by you through use or reliance on this information. Saville and OFML’s liability for negligence, breach of contract or contravention of any law, which cannot be lawfully excluded, is limited, at Saville’s option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you.